Core Banking Solution (CBS): In today’s digital age, banking has undergone a massive transformation, and core banking solutions have emerged as the driving force behind this evolution. These innovative software systems have revolutionized the way banks operate, enabling them to provide seamless and efficient services to their customers.

What Is Core Banking Solution (CBS)?

At its core, a core banking solution (CBS) is a comprehensive software platform designed to manage and automate various banking operations. It serves as the backbone of a bank’s digital infrastructure, allowing customers to conduct transactions and access banking services from any branch or digital channel, regardless of where they initially opened their account.

CBS systems handle a wide range of banking activities, including deposit accounts, loans, mortgages, payments, and customer information management. They ensure real-time updates, ensuring that a customer’s account balance and other information remain current and accurate at all times.

The Importance of Core Banking Solutions in Modern Banking

In today’s fast-paced world, core banking solutions have become indispensable for banks, streamlining operations, improving efficiency, and enhancing customer satisfaction. Here are some key reasons why CBS systems are crucial:

- Real-time Processing: CBS systems enable real-time processing and updating of transactions, which is essential for both the bank and its customers in today’s fast-paced environment.

- Flexible Banking: Through CBS, banks can provide anytime, anywhere banking services to their customers. Customers can perform banking transactions from any branch or online platform, improving convenience and access.

- Cost Efficiency: CBS systems reduce operating costs by automating many manual processes, making banks more competitive and efficient.

- Improved Customer Service: CBS centralizes customer data and offers a more personalized customer experience, enhancing overall satisfaction.

- Risk Management: CBS systems help assess risks and detect fraud by providing a comprehensive view of customers’ activities, enabling proactive measures and safeguarding the bank’s interests.

Benefits of Core Banking Solutions

The advantages of core banking solutions extend far beyond operational efficiency. They offer the ability to scale and adapt to changing banking needs and technologies while meeting the increasing demands of customers.

Moreover, CBS integrates seamlessly with third-party applications and services, enabling banks to provide a broader range of services and improve their overall offerings.

Some of the key benefits of core banking solutions include:

- Scalability and Flexibility: CBS systems are designed to accommodate growth and evolving business requirements, ensuring that banks can adapt to changing market dynamics and customer needs.

- Enhanced Customer Experience: By centralizing customer data and automating processes, CBS solutions enable banks to deliver a more personalized and streamlined experience, increasing customer satisfaction and loyalty.

- Increased Operational Efficiency: Automating manual processes and streamlining operations through CBS solutions leads to significant cost savings and improved operational efficiency for banks.

- Improved Risk Management: With real-time monitoring and comprehensive data analysis capabilities, CBS systems help banks identify and mitigate potential risks, ensuring compliance and minimizing financial losses.

- Integration with Third-Party Services: CBS solutions offer seamless integration with third-party applications and services, enabling banks to expand their offerings and stay competitive in the ever-evolving financial landscape.

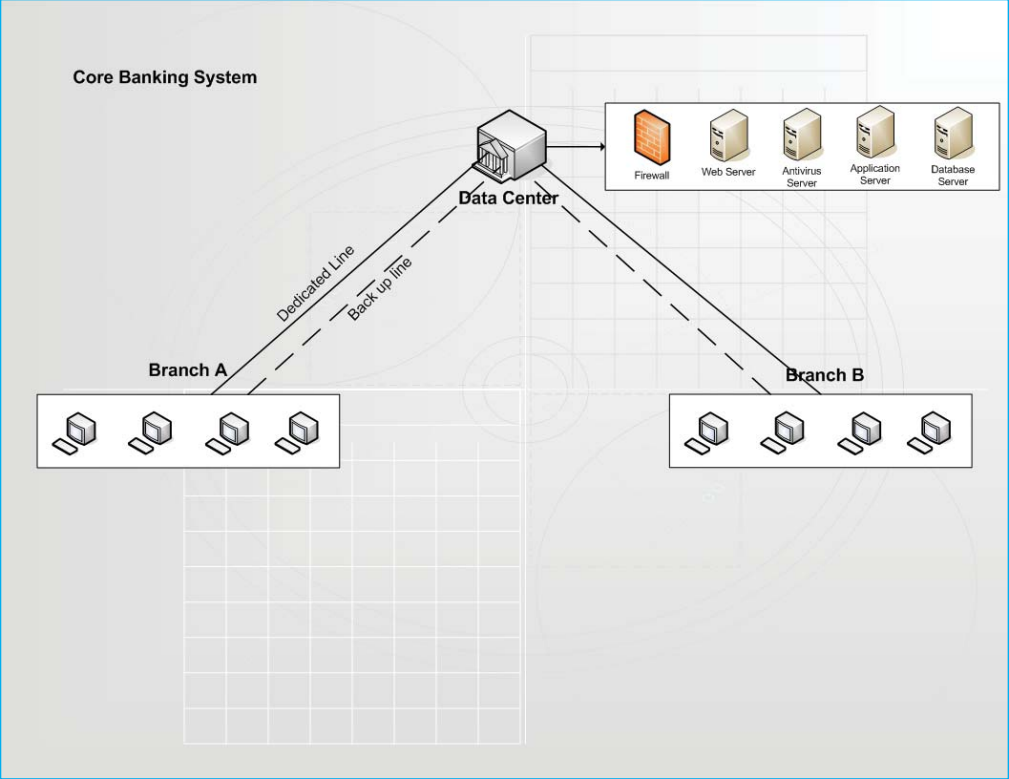

Core Banking Solutions Architecture

Core banking solutions are typically designed with a multi-tiered architecture that facilitates scalability, performance, and security. This architecture includes:

- Data Layer: This layer forms the base where all the bank’s data, including customer information, transaction details, and account data, is securely stored.

- Business Logic Layer: This layer contains the core functionality of the banking system, processing transactions, managing accounts, and handling all banking operations.

- Application Layer: This layer interacts directly with end-users, bank employees, or customers through various digital platforms, providing user interfaces and applications for various banking services.

- Integration Layer: This layer enables communication with external systems, such as ATMs, payment gateways, mobile banking apps, and more, ensuring seamless integration and data exchange.

Each layer communicates with the others as needed, ensuring smooth and efficient operations. This modular design allows banks to upgrade or modify one layer without affecting the others, making it easier to adapt to changes and advancements in technology.

How Core Banking Solutions Work

Core banking solutions centralize and automate banking operations by leveraging a robust database that stores all customer information, account details, transaction history, and other relevant data. This database updates in real time as transactions occur.

When a customer initiates a transaction, such as making a deposit, withdrawing funds, or transferring money, the CBS processes the transaction. The system verifies the customer’s identity, checks account balances, and updates the account accordingly. Simultaneously, it records the transaction in the customer’s account history.

For bank employees, the CBS provides tools for managing customer accounts, processing transactions, and providing customer service. It allows them to perform administrative tasks like opening new accounts or processing loan applications.

In essence, CBS acts as the digital backbone of a bank, streamlining operations and making banking more convenient for customers and employees alike.

Functionalities of Core Banking Solutions

Core banking solutions offer a wide range of functionalities designed to support various aspects of banking operations. Some key functionalities include:

- Account Management: Allows banks to manage different types of accounts, such as savings, current, fixed deposits, and loans.

- Transaction Processing: Handles all monetary transactions, including deposits, withdrawals, transfers, and payments, ensuring accurate and efficient processing while updating account balances in real time.

- Customer Relationship Management: Tracks customer interactions, manages customer inquiries, and analyzes customer data to understand their needs and preferences better.

- Risk Management: Identifies, assesses, and manages various risks, such as credit risk associated with lending, market risk related to changes in financial services, and operational risk arising from day-to-day banking operations.

- Reporting and Analytics: Provide robust reporting and analytics capabilities to generate various financial and operational reports, enabling data-driven decision-making.

- Compliance Management: Helps banks comply with various regulatory requirements, including monitoring transactions for suspicious activity, maintaining necessary documentation, and generating reports for regulatory bodies.

- Product Management: Allows banks to manage their offerings, from traditional products like loans and deposits to newer offerings like mobile banking services, enabling the launch of new products and managing product features, pricing, and eligibility criteria.

Emerging Trends in Core Banking Solutions

As technology continues to evolve, core banking solutions are also experiencing advancements to keep pace with the changing landscape. Some notable trends in core banking solutions include:

- Adoption of Cloud-based Solutions: Cloud-based solutions in core banking are gaining traction due to their scalability, flexibility, and cost-effectiveness. They allow banks to manage and access data from anywhere, reduce infrastructure costs, and quickly adjust to changing demands.

- Integration of AI and ML: Artificial Intelligence (AI) and Machine Learning (ML) are being increasingly integrated into core banking solutions to enhance various aspects of banking, such as customer service, fraud detection, and risk management.

- Usage of APIs for Third-Party Integration: Application Programming Interfaces (APIs) are becoming more common in core banking systems to facilitate easy integration with third-party services, enabling banks to provide a broader range of services and enhance the customer experience.

- Leveraging Blockchain Technology: Blockchain technology offers promising applications in core banking due to its transparency, security, and decentralization. It creates a tamper-proof transaction ledger, making audits simpler and fraud more difficult while streamlining cross-border payments and remittances.

The Role of Technology in Core Banking Solutions

Technology plays a pivotal role in core banking solutions, enabling them to provide efficient, reliable, and innovative services. It automates numerous banking processes, from account management to transaction processing, reducing manual effort and the chances of errors while enhancing operational efficiency and speed.

With the help of technology, CBS can execute and update transactions in real-time, ensuring up-to-date account information. Moreover, modern technology allows CBS to securely manage and process vast data volumes while delivering a remarkable customer experience.

Emerging technologies like AI, machine learning, blockchain, and cloud computing offer new avenues for innovation in CBS, creating more personalized services, enhancing security, improving compliance, and increasing efficiency.

Customers benefit from around-the-clock banking, faster services, convenience, and accurate transactions. Businesses gain from process standardization, customer retention, reduced errors, cost savings, compliance, and improved decision-making.

In conclusion, core banking solutions (CBS) are integral to modern banking, offering a wide range of benefits to both customers and financial institutions. As technology continues to advance, CBS will evolve to meet the ever-changing needs of the banking industry.