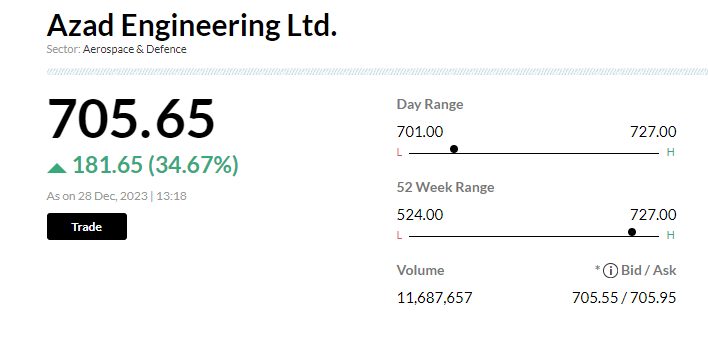

Azad engineering share price nse: Azad Engineering Ltd witnessed a robust debut at Dalal Street as the manufacturer of aerospace components and turbines premiered at Rs 720, representing a premium of 37.40 per cent, on the National Stock Exchange, compared to the issue price of Rs 524 per share. The stock was listed at a premium of 35.50 per cent at Rs 710 on the BSE.

The listing of Azad Engineering aligned closely with expectations, given that the company commanded a premium of Rs 200-210 per share in the grey market before its listing, suggesting a potential listing pop of around 40 per cent for investors. However, the premium in the unofficial market was approximately Rs 440 before the commencement of the bidding process.

Azad Engineering, backed by Sachin Tendulkar, offered its shares in the fixed price range of Rs 499-524 each, with a lot size of 28 equity shares, from December 20 to December 22. The company successfully raised Rs 740 crore through its IPO, comprising a fresh share sale of Rs 240 crore and an offer-for-sale of up to 95,41,985 equity shares.

The IPO garnered significant attention, with an overall subscription rate of an impressive 80.65 times. Qualified institutional bidders played a substantial role, oversubscribing their portion by a remarkable 179.66 times. Non-institutional investors’ participation was strong, with a subscription rate of 87.61 times. Retail investors and employees also showed interest, subscribing 23.79 times and 14.71 times, respectively.

Azad engineering share: Company Profile

Established in 1983, Azad Engineering specializes in manufacturing aerospace components and turbines, supplying its products to original equipment manufacturers (OEMs) in the aerospace, defense, energy, and oil and gas sectors. The company’s products are highly engineered, complex, mission-critical, and essential.

Sachin Ramesh Tendulkar, the legendary cricketer, invested around Rs 5 crore in the company in March 2023. He acquired 14,607 equity shares at a price of Rs 3,423 each, which later converted into 3,65,175 equity shares post stock split and bonus issue, as per the RHP of the company. The average price of Sachin’s holding amounted to Rs 136.92 per share.

The book running lead managers for the Azad Engineering IPO are Axis Capital, ICICI Securities, SBI Capital Markets, and Anand Rathi Securities, while Kfin Technologies serves as the registrar for the issue.

Azad engineering share: Financials

The company reported a 31% year-on-year surge in revenue from operations to ₹261 crore, but its net profit for the financial year 2023 plummeted by 71% to ₹8.4 crore. Over the period from FY21 to FY23, the company achieved a noteworthy CAGR of 43% in revenue growth and a corresponding CAGR of 49% in PAT margin.

Azad holds a prominent position as a key manufacturer of qualified product lines, catering to global original equipment manufacturers (OEMs) in the energy, aerospace and defence, and oil and gas industries. Specializing in the production of highly engineered, complex, and mission and life-critical components, the company manufactures precision-forged and machined components, some of which require zero defects per million due to their critical nature.

Competing on a global scale with manufacturers from China, Europe, the USA, and Japan, Azad’s customer base includes renowned global OEMs such as General Electric, Honeywell International Inc., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Eaton Aerospace, and MAN Energy Solutions SE.

Net-profit margin

| Year | Revenue | Profit |

|---|---|---|

| 2023 | 251.67 | 8.47 |

| 2022 | 194.47 | 29.46 |

| 2021 | 122.72 | 11.50 |

Azad Engineering share price target

Azad Engineering’s share price is anticipated to exhibit volatility throughout the year, with analysts projecting a maximum price target of Rs 955 in December 2024 and a minimum price target of Rs 696 in March 2024.

The consensus among analysts for Azad Engineering’s average price target in 2024 is around Rs 820.

The prediction for Azad Engineering’s share price targets in 2024 relies on an analysis of the company’s financials, historical trends, and reports from various brokerage firms.

Comments are closed.